list of deductible business expenses pdf

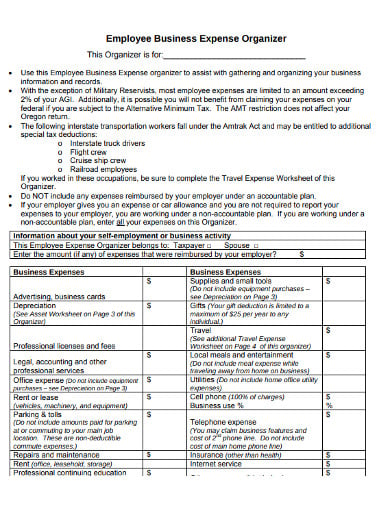

Business Expenses Deductible for Sole Proprietors. If you are an employee complete Form 2106 Employee Business Expenses.

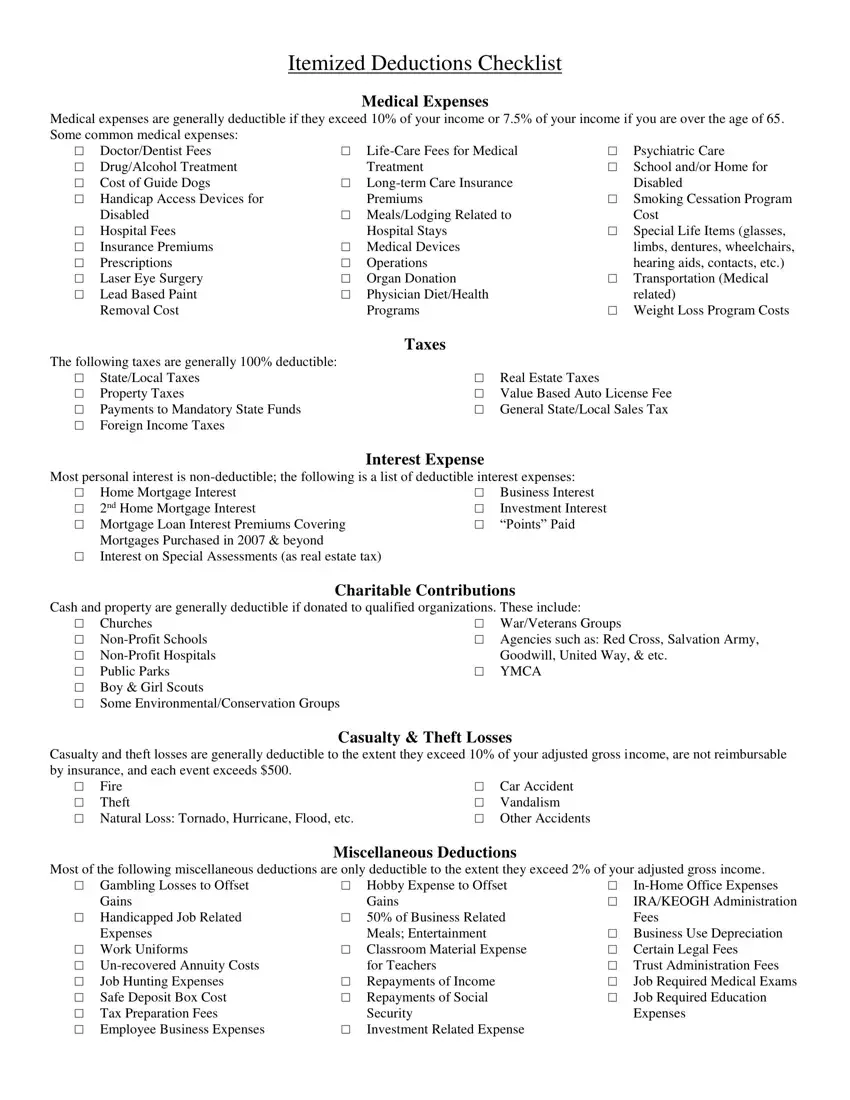

Itemized Deductions Checklist Fill Out Printable Pdf Forms Online

Enter on Schedule A Form 1040 that part of the amount on Form 2106 that is related to your impairment.

. In an insurance policy the deductible in British English the excess is the amount paid out of pocket by the policy holder before an insurance provider will pay any expenses. Deductible expenses for business use of your home include the business portion of real estate taxes mortgage interest rent casualty losses utilities insurance depreciation maintenance and repairs. Medical savings account MSA Do not deduct as a qualified medical expense amounts contributed to an Archer MSA.

For business expenses paid personally there needs to be a clear plan. Also certain maintenance or personal care services provided for qualified long-term care can be included in medical expenses. How to Deduct Medical Expenses 1.

Have a far simpler process to follow to deduct medical expenses. When trying to reimburse yourself personally for business expenses the IRS might consider those reimbursements as fringe benefits and that has a large tax implication. In general usage the term deductible may be used to describe one of several types of clauses that are used by insurance companies as a threshold for policy payments.

Deductibles are typically used to. We know youre asking yourself right now if. A business can pay for medical insurance and medical expenses of employees but the manner in which those are deductible differ from type to type.

However certain expenses paid to a person providing nursing-type services may be deductible as medical costs. Revenue Procedure 2013-13 PDF allows qualifying taxpayers to use a prescribed rate of 5 per square foot of the portion of the home used. Options for Businesses with Employees.

If you are self-employed deduct the business expenses on the appropriate form Schedule C E or F used to report your business income and expenses. Business owners of startups and self-employed individuals.

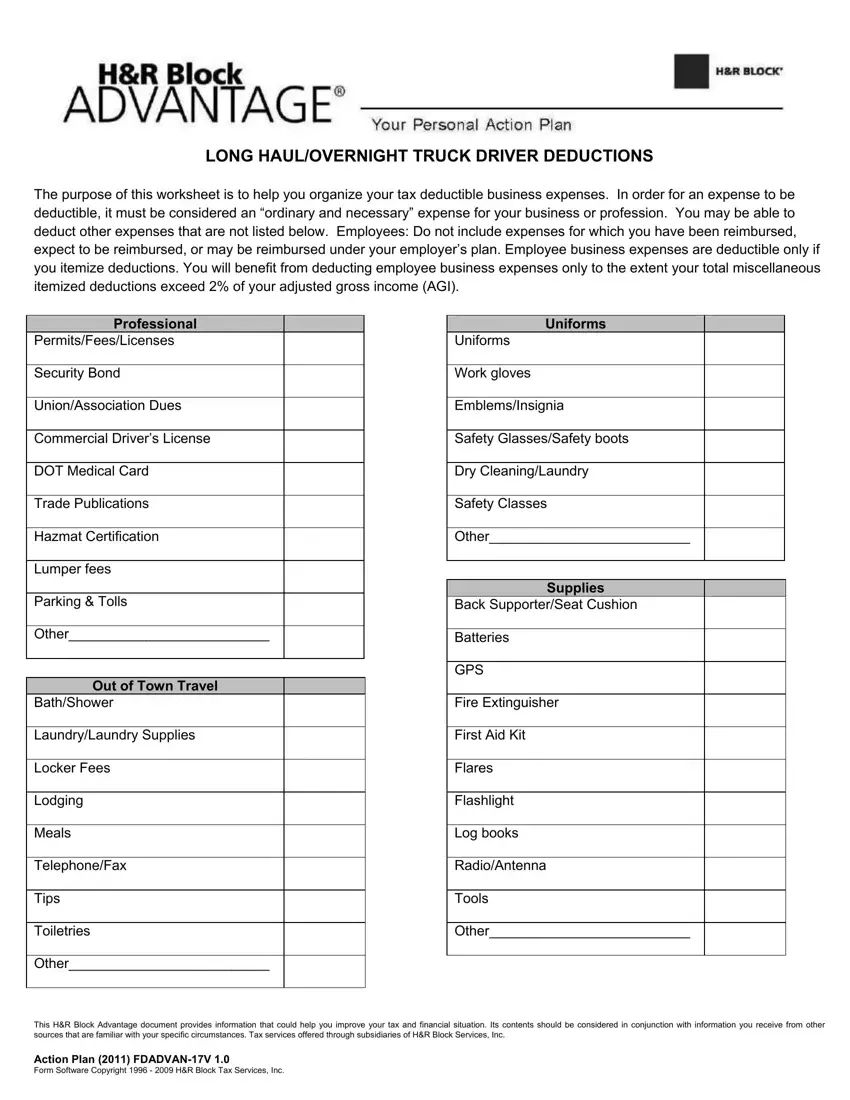

Truck Driver Expenses Worksheet Fill Out Printable Pdf Forms Online

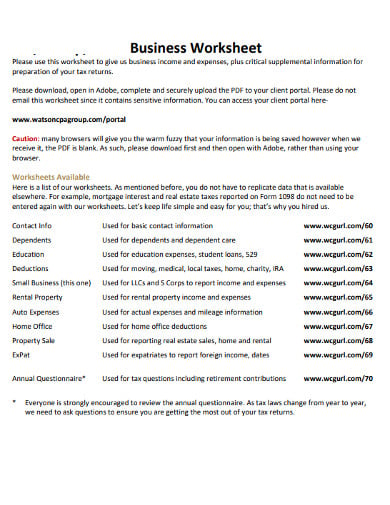

Expense Tracking Chart Pdf Form For Download Small Business Expenses Business Expense Tracker Expense Sheet

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Small Business Tax Business Tax Deductions Business Tax

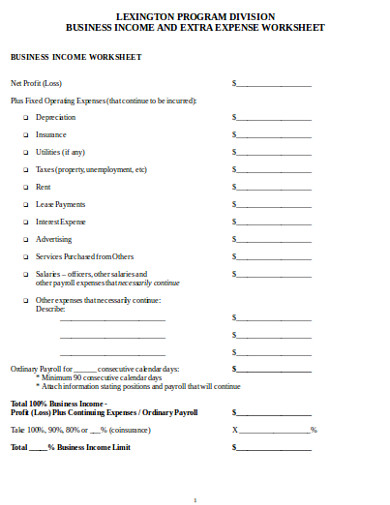

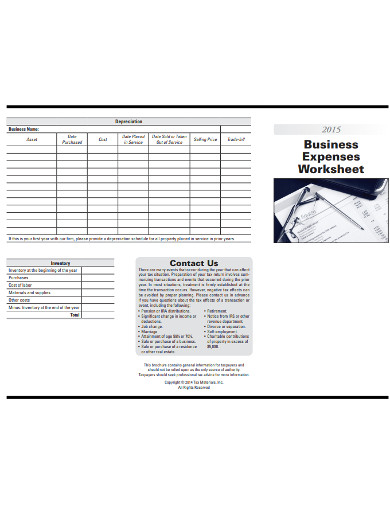

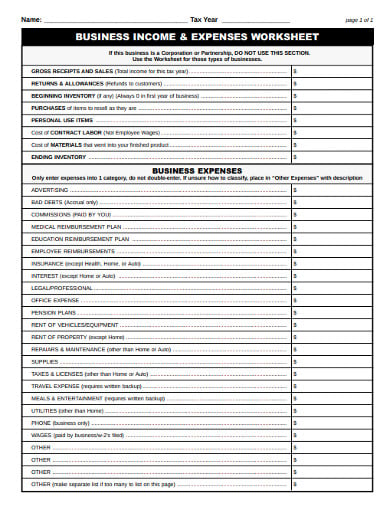

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

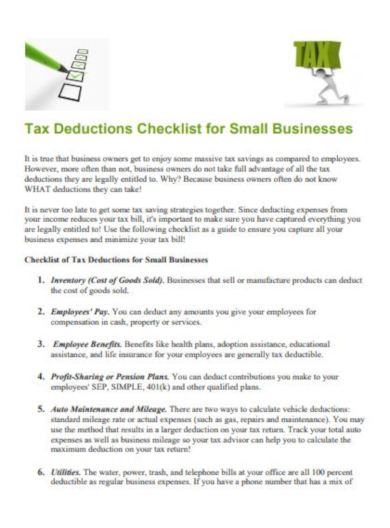

6 Deduction Checklist Templates Google Docs Word Pages Pdf Free Premium Templates

Monthly Business Expense Worksheet Template Business Budget Template Business Expense Small Business Expenses

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

Free 6 Sample Unreimbursed Employee Expense In Pdf

Small Business Tax Spreadsheet Business Worksheet Small Business Tax Deductions Business Tax Deductions

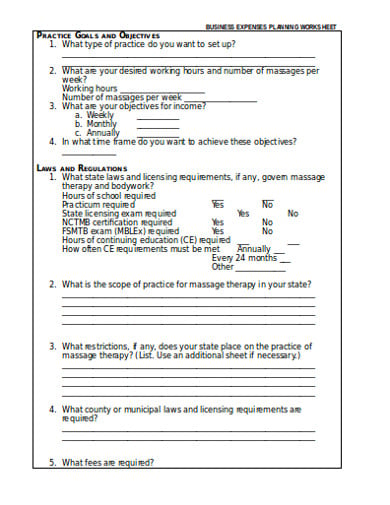

Private Practice Tax Write Offs Free Pdf Checklist

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

Truck Expenses Worksheet Spreadsheet Template Driving Jobs Printable Worksheets

Expense Printable Forms Worksheets Spreadsheet Business Expenses Printable Small Business Expenses

Free Printable Income And Expense Worksheet Pdf From Vertex42 Com Budgeting Worksheets Expense Tracker Printable Budget Planner Printable

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

Printable List Of Tax Deductions Fill Out And Sign Printable Pdf Template Signnow